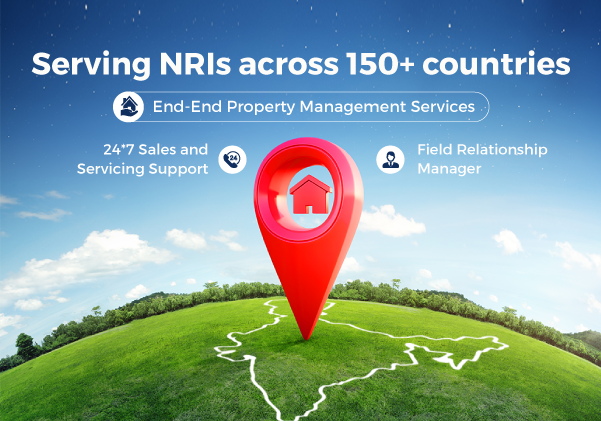

NoBroker NRI Services

Customer stories

( Rated on Facebook ★★★★★

4.6/5, 2739 Reviews )

NoBroker NRI Services

FAQ's

What is the best investment for NRI in India?

There are many investment opportunities for NRIs in India such as –

- Direct Equity

- Mutual Funds

- Fixed Deposit

- National Pension Scheme

- Public Provident Fund

- Real Estate.

Of these options, Real Estate is considered most stable and a more rewarding form of investment in India.

Can a foreigner buy property in India?

No, any person who is not of Indian origin and who resides outside India cannot purchase immovable property in India. The only exception is if they acquire the property by way of inheritance from a person who was a resident in India.

Unless they reside in India for 183 days in a financial year, it is not legal for foreigners to own property in India. Foreigners can’t buy property using a tourist visa and a tourist visa will allow them to stay for only 180 days.

A foreigner also can’t buy a property jointly, one eligible person with one non-eligible person can’t buy property in India.

How much tax do I pay on the sale of property in India?

If you sell your property within 3 years of acquiring it, it’s considered to be a short-term capital gain. If you sell the property anytime after 3 years, it is considered to be a long-term capital gain.

Long term capital gains tax is 20% plus a cess of 3%. The short-term capital gains tax is taxed by including the short-term capital gain along with the total income for the individual and taxed per the applicable slab rate.

How can I avoid capital gains tax on property sales in India?

How can I save taxes when I sell my house?

Can OCI buy property in India?

If you have an Overseas Citizenship of India, then you can buy ONLY residential and commercial property in India. You will not be allowed to buy agricultural land/plantation property or even a farmhouse in India.

How many properties NRI can buy in India?

An NRI can buy any number of residential or commercial properties in India there is no limit on this. An NRI, however, can’t purchase any agricultural land or plantation land.